Stay informed about the early stage investing ecosystem and the technology sector at large by browsing through cutting-edge reports from prominent organisations in the industry:

2024 H1 Review by Sifted – Europe Sheds Some Downturn Ghosts

Compared to the previous 6 months in 2023, the first half of 2024 is seeing a resurgence of investments within the European tech ecosystem. Around €47.3bn, which includes €18.7bn debt

Center for Venture Research: THE ANGEL MARKET IN 2023: AN INFLECTION POINT FOR WOMEN ANGELS?

The angel investor market in 2023 exhibited an increase in active investors, but a decline in the number of investments and the total dollars invested by angels, according to the

LEAPFUNDER: State of the Startup Market Report Q1 2024

During each quarter Leapfunder prepares a State of the Startup Market Report and have just issued Q1 of 2024. In this report they go over developing startup hubs in Germany

AEBAN: Annual 2023 Report

AEBAN presents its VIII Annual Report on the activity of Business Angels in Spain during the year 2023, prepared by the team of the Business Angels Network of the IESE

EstBAN: Investment Summary 2023

Once a year, the Estonian Business Angels Network conducts a survey among its members, asking investors to share their investments made during the year. Last year in 2023 they have

FiBAN Press Release: 30% decrease in angel investments and increase in bankruptcies

The Finnish Business Angels Network (FiBAN) reports a significant decline in angel investments in Finnish startups during 2023, with funding dropping from €37 million to €26 million compared to the

Investors Portugal: “Early Stage Investment Barometer 2023”

Lisbon, February 5, 2024 – Eight out of ten (79%) Portuguese early stage investors are dissatisfied with public policies for the sector. According to the “Early Stage Investment Barometer 2023”,

Survey of Czech Startup Investors | 2023

In the ongoing effort to support and develop the Czech startup ecosystem, EBAN member Depo Ventures are providing you with exclusive and extensive data from business angels, LPs, GPs, and

European Data Insights report

Our partner Carta is a proud sponsor of the freshly-released European Data Insights. Read full report here.

State of Gender Diversity in European Venture report

Our partner Carta is a proud sponsor of the freshly-released State of Gender Diversity in European Venture report – the most comprehensive analysis of the funnel of female innovation in Europe. Read the

Business Angel Guide to Investment in the SpaceTech Sector

The European space sector benefits from being diverse, robust, and enjoying rapid growth in recent years. European nations have a long history of cooperation in space research, technology development, and

State of the European Tech Report

The State of the European Tech executive summary encapsulates the most crucial data points of the year. Delving into key indicators of the ecosystem’s health, it meticulously spotlights both favorable

EBAN Annual Statistics Compendium for 2022

EBAN presents the EBAN Annual Statistics Compendium for 2022, Europe's most extensive annual research on the activity of business angels and business angel networks. The Compendium offers comprehensive insight into

EBAN Data Report: Business Angel Networks and Angel Federations in Europe 2023

This report by EBAN provides a list of all Business Angel Networks and Federations currently active in Europe. It has been compiled through a combination of online resources and data

EIF Venture Capital Survey 2023 : Market sentiment, scale-up financing and human capital

The EIF VC Survey and the EIF Private Equity Mid-Market Survey (the largest combined regular survey exercises among General Partners on a pan-European level) provide an opportunity to retrieve unique

Capital Markets Union Key Performance Indicators – Sixth Edition 2023

The Association for Financial Markets in Europe (AFME) and EBAN, in collaboration with ten other European and international organisations, has today published the sixth edition of the ‘Capital Markets Union

Patents, trade marks and startup finance – Report by EUIPO

Patents, trade marks and startup finance This study examines the role of intellectual property (IP) rights – specifically patents and trade marks – in facilitating access to finance for European

Best Practices of Angel Investing

Best Practices of Angel Investing Exciting News from Dealum! Dealum has just released their latest project, a FREE online book titled “Best Practices of Angel Investing.” This comprehensive guidebook is

FiBAN Startup questionnaire 2023

FiBAN publishes the results of their startup questionnaire sent to startups who have sought funding through the FiBAN. The goal of the questionnaire was to acquire information about improving the

NLC’s Health Impact Fund Initial Close

NLC’s Health Impact Fund is their latest flagship fund that aims to bridge this widening healthcare gap between innovation and the market. With a target size of €100 million, it

Leapfunder’s Startup Market Report Q2 2023

Are you interested in the state of the current startup market? Check out the report our member Leapfunder prepared for the Netherlands and Germany for Q2 2023. Read the full

Emerging Tech Future Report: Generative AI

A new dawn in tech has arrived: The generative AI craze has taken hold—and it’s showing no sign of letting up. What does this new epoch mean for investors and

The State of Adria Tech 2021-2022

Business angels of Slovenia were among the leading partners in preparing The State of Adria Tech report led by Silicon Gardens. The research examines tech companies that have received investments

Austrian Investing Report 2022

With the Austrian Investing Report 2022, the pre-IPO investment activity in Austria was comprehensively examined for the first time. The knowledge gained now provides information about the investment motives and

DanBAN Investor Report 2022

The DanBAN member survey stands out for its ability to offer a comprehensive understanding of how private investors fund growth companies in Denmark, and it is unique in its approach

Practices of European Venture Capitalists

The European venture capital (VC) market picked up and proliferated after the 2008 economic breakdown but faced a sharp slowdown in the second half of 2022 and 2023. Starting the

Business Angels in the Czech Republic in 2022

Czechs are among the most skilled investors in startups. Their strategies have generally been successful so far. Almost nine out of ten investors were able to make a profit on

Business Angel Investing in Finland 2022

FiBAN’s annual study of investments and exits maps the development and impact of angel investments. In 2022, Finnish angels invested 37 million euros in 248 growth companies, says the latest

Discover Guide to Business Angels

Wondering how to protect your brand? This Discover Guide made by EUIPO in collaboration with EBAN will help you understand whether you have protection for your brand, and, if not,

NLC’s 2022 Impact Report

Get the news you need from NLC’s 2022 Impact Report. Laser-focused on healthtech innovation, NLC successfully built its 100th venture in 2022, aiming to connect much-needed early-stage technologies with patients.

The SICTIC Investment Report 2023

According to the Swiss ICT Investor Club (SICTIC) 2023 investment report, year 2022 turned out to be a very strong for venture capital in Switzerland. This growth was primarily driven

EBAN Data – Agrifood sector in Europe

In this EBAN Data Monthly Report, we present an overview of the agrifood entrepreneurial and investment ecosystem in Europe (including Türkiye), with a focus on the investments in Agrifood companies

Driving Equity: The Latest on Women in Innovation

Supernovas’ latest study found that the 2021-2022 period had seen the most venture capital investment in women-founded scale-ups with over USD 9 billion invested over those two years. European investors

EBAN Impact Investing Report 2021 – 2nd Edition

EBAN Impact Publishes its 2nd Annual Impact Investing Report – Reporting on Investor Background and Investment Characteristics EBAN Impact is delighted to announce the publication of our 2nd edition of

The 2023 European Deep Tech Report by Dealroom

This report explores the latest trends in deep tech, VC, university spinouts, and more. It found that European deep tech startups raised $17.7B in 2022, a 22% decrease from 2021.

TNS Final Report: Unleashing innovation in the Mediterranean by Supporting 200 Startups

THE NEXT SOCIETY, a five-year project aiming to reinforce the innovation ecosystem in the Middle East and North Africa, supported 200 startups, 65% of which have a direct impact on SDGs.

Private equity forecast: Europe’s investors brace for 2023

As the private equity industry emerges from a tumultuous 2022—marked by volatile macroeconomic conditions driven by soaring interests and geopolitical tensions—its participants are bracing for another challenging year. PitchBook reached

Impact startups – 2022 review

After a record year for impact startups in 2021, investment into the impact ecosystem is down 25% in 2022, with $57B raised globally. In 2022, impact investment in the US

The next generation of tech ecosystems

In their recent report dealroom.co analysed over 201 tech ecosystems. According to them, the coming years will be dominated by radical innovation and a need for next-generation types of tech

Recessions, Resilience And Returns: Here Are 8 Tech Sectors Primed For Growth

According to Crunchbase, the global economy will fall into a recession in the first quarter of 2023 (if it’s not already). Recessions typically last 15 months (2008 was 18) followed

State of European Tech

Atomico published its ”State of European Tech” report: EU tech faces new challenges, but remains resilient. After a record-breaking first half year, the flywheel slowed this summer in response to

ACA Angel Funders Report 2022: More Data + Industry Insights and Real Stories

ACA publishes the Angel Funders Report annually to increase awareness about angel investor activity and build a deeper understanding of the investing environment. According to the 2022 report, ACA members

Capital Markets Union Key Performance Indicators – Fifth Edition by AFME

AFME, EBAN, and 10 other organisations published the fifth edition of the “Capital Markets Union – Key Performance Indicators” report. Over the last five years, this report has tracked the

How do the best business angels in Poland invest? – Polish angel investment market in 2021

The new Report on the angel market in Poland shows how this area of investment activity is shaping up. Venture Capital funds have been operating on the Polish market for

EIF Working Paper 2022/82, EIF Venture Capital Survey 2022: Market sentiment and impact of the current geopolitical & macroeconomic environment

The EIF VC Survey, the EIF Private Equity Mid-Market Survey, and the EIF Business Angels Survey (the largest combined regular survey exercises among General Partners and Business Angels on a pan-European level) provide an opportunity

Global VC Pullback Is Dramatic In Q3 2022

Crunchbase Reports that Global VC Pullback Is Dramatic in Q3 2022: The big global venture capital pullback we were all expecting is truly here. Venture and growth investors in private companies scaled

The open database for university spinouts

June 2022 database release The Spinout.fyi database is publishing its raw survey data, in order to level the information playing field for spinout founders who often enter negotiations not knowing what to

Statistics Compendium 2021 European Early Stage Market Statistics

EBAN Publishes its Annual Statistics Compendium - Reporting on the Activity of Business Angels and Business Angel Networks in Europe Data on the investments made across the 38 different European

Women Angel Insights Report

New study reveals investments worth £2 billion made by female angels helping to create 10,000 UK jobs First comprehensive picture of female angel investment in the UK reveals thousands of

UNH Research Finds Angel Investor Behavior Can Be Influenced by Ego

UNH Research Finds Angel Investor Behavior Can Be Influenced by Ego Angel investors—wealthy individuals who provide essential funds for start-ups—often invest under conditions of extreme uncertainty. While their funds can

EIF Business Angels Survey 2021/22: Market Sentiment by EIF Research and Market Analysis

EIF Business Angels Survey 2021/22: Market Sentiment The EIF Business Angels Survey, together with the EIF VC Survey and the EIF Private Equity Mid-Market Survey (the largest combined regular survey exercises among GPs and Business

Q2 VC Funding Globally Falls Significantly As Startup Investors Pull Back by Crunchbase

Q2 VC Funding Globally Falls Significantly As Startup Investors Pull Back Global funding slowed dramatically in the second quarter of 2022 as investors shied away from later-stage funding bets. It

European Venture Report – Q2 2022 by PitchBook

European Venture Report - Q2 2022 European venture funding is on pace to surpass €100 billion for the second consecutive year, but dealmaking activity could slow as markets enter correction

Ranking investors – EMEA 2022 by Dealroom.co

Ranking investors – EMEA 2022 40% of startups backed by top quartile investors go on to raise Series A, compared to just 7% for bottom quartile funds, and only the

Empowering European Digital Leaders: After Regulation, Let’s Quickly Promote Innovation by Euractive

Empowering European Digital Leaders: After Regulation, Let’s Quickly Promote Innovation Europe’s landmark digital regulation has laid the groundwork in record time for a new framework that will hold digital giants

2021 Central and Eastern Europe Private Equity Statistics by Invest Europe

2021 Central and Eastern Europe Private Equity Statistics The 18th annual edition of the Central and Eastern Europe Private Equity Statistics delves into countries across CEE to show the spread

The Performance of European Private Equity Benchmark Report 2021 by Invest Europe

The Performance of European Private Equity Benchmark Report 2021 The research shows that European private capital continued to strongly outperform listed equity benchmarks, delivering superior performance to long-term investors to

The State of European Insurtech 2022 by Dealroom.co, mundi ventures, MAPFRE, NN Group

The State of European Insurtech 2022 This report wants to bring transparency through data and qualitative insights on the current state and trends of European and global Insurtech. The report

The Angel Market in 2021: Metrics Indicate Strong Market – By Center for Venture Research

The Angel Market in 2021: Metrics Indicate Strong Market The angel investor market in 2021 exhibited an increase in active investors, the number of investments, and the total dollars invested

Ukrainian ІТ Industry: Reboot in the Wartime – by IT Ukraine Association

Ukrainian ІТ Industry: Reboot in the Wartime The rapid growth of the industry by more than 50% during 2019-2021 continued up to the War and, according to the National Bank

Ukraine IT Report 2021 – by IT Ukraine Association

Ukraine IT Report 2021 In 2021, the Ukrainian IT industry grew by 36% from USD 5 billion to USD 6.8 billion in exports. At the same time, the number of

Ranked: The Most Prominent VC Investors in EMEA – 2022 by Dealroom.co

Ranked: The Most Prominent VC Investors in EMEA – 2022 Dealroom.co presents a practical ranking of venture capital investors, a tool to help founders navigate the vast, and at times opaque

EBAN Impact Investing Survey

EBAN Impact Investing Survey We are proud to be driving research surrounding impact investing in startups that are dedicated to a societal or environmental cause. This is why we are

Global M&A Report by PitchBook

Global M&A Report Global M&A activity bifurcated for much of Q1 2022, with previously negotiated deals closing on time while announced activity diminished due to the uncertainty created by Russia’s

European Venture Report by PitchBook

European Venture Report The Q1 European Venture Report takes a deep dive into the key trends that shaped this first quarter, breaking down activity across dealmaking, exits and fundraising, as

Number of Investments Made by EstBAN Members Tripled in 2021

EstBAN members invested 29.9M euros into startups, which is an all time high. From the total amount, 13.5M was angel investments, 14.9M through funds and 1.45M euros was invested through

France Angels, BILAN DES INVESTISSEMENTS 2021

France Angels presents the “Bilan des Investissements 2021”

Business Angels in The Czech Republic 2021

Depo Ventures presents Business Angels in The Czech Republic 2021 The aim of the report is to map the environment of the angel investing in Czech Republic. To find out

Foodtech Startups and Venture Capital – Q1 2022 by Dealroom.co

Amid war, supply chain volatility and an inflationary environment, the report dives into how the $1.1 trillion foodtech industry fared in Q1 2022, and where the $9.2B of VC investment

Biannual Report on Financial Integration by European Central Bank

When we talk about euro area financial integration, we mean the extent to which financial services are available under the same rules and conditions in all countries that use the

European Financial Stability and Integration Review

The European Financial Stability and Integration Review (EFSIR) is an annual review published by the European Commission. Among other topics, it reports on developments in finance, markets and banking, and

Business Angel Investing in Finland 2021 by FiBAN

Investment activity of private startup investors reached a new high in 2021, following the decline of covid-year 2020. Majority of growth funding went to companies closing their first investment round.

Do We Need EU Social Taxonomy? By EVPA

Do We Need EU Social Taxonomy? By EVPA EU standards for sustainable finance can encourage investments that will enable a green and just transition, but only if they act as

In Search of EU Unicorns – What Do We Know About Them?

The Joint Research Centre (JRC), the European Commission’s science and knowledge service presents: In Search of EU Unicorns – What Do We Know About Them? This paper provides insights into the

Invest in Software Companies

Invest in Software Companies – How to Assess SaaS Companies by Verve Ventures This report aims to give a framework for assessing SaaS companies and foster an understanding of this

Sweden Tech Ecosystem: Report 2021

Dealroom.co presents: Sweden Tech Ecosystem: Report 2021 2021 was a record year for the Swedish ecosystem. VC investment more than doubled in the last year alone, hitting an all-time high

Danish Biotech: a Rapid Rise

Dealroom.co present Danish Biotech: a Rapid Rise Covid provided a big publicity opportunity for biotech. Investors of all kinds started taking interest in the companies that had the power to

European VC Valuations Report

PitchBook presents European VC Valuations Report. European VC valuations continued to break records in 2021 across all stages as investors competed fiercely to participate in outsized rounds. Pandemic-induced growth for

Emerging Venture Markets Report

MAGNiTT presents Emerging Venture Markets Report. With over $6.9B raised through 1,300+ deals and 80+ startup exits recorded, 2021 was a defining year for the Venture Capital ecosystem in Emerging

Tackling the Scale-up Gap

Joint Research Centre (JRC) presents Tackling the Scale-up Gap The number of scale-up businesses in the EU, particularly unicorns, lags behind the US and China. This is partially attributed to

Healthcare Predictive Analytics Market Overview

Deep Knowledge Group presents Healthcare Predictive Analytics Market Overview Healthcare Predictive Analytics market is projected to grow at a rate of 28.9% in terms of value, from USD 3.74 Billion

Navigating impact measurement and management – How to integrate impact throughout the investment journey

EVPA presents Navigating impact measurement and management – How to integrate impact throughout the investment journey which demonstrates how impact measurement and management is deeply embedded into the DNA of investing for impact and

The State of European Tech

Atomico presents The State of European Tech, the most comprehensive data-driven analysis of European technology. What does Europe’s tech talent look like now? And how has Covid-19 affected the region’s

Swiss Angel Investor Handbook

SICTIC, Swiss ICT Investor Club presents Swiss Angel Investor Handbook. This handbook is a condensed collection of wisdom from many successful angel investors, and will familiarize you with concepts of

Template Convertible Loan Agreement for Angel Investments

EBAN is happy to share the new Template Convertible Loan Agreement for Angel Investments, by Austrian Angel Investor Association (AAIA). The template below. Template Convertible Loan Agreement

Statistics Compendium 2020 European Early Stage Market Statistics

EBAN Publishes its Annual Statistics Compendium - Reporting on the Activity of Business Angels and Business Angel Networks in Europe EBAN, the European Business Angels Network, is delighted to announce

Investment Digest Longevity – Industry Q3 2021

Deep Knowledge Group presents Investment Digest Longevity Industry Q3 2021 This Investment Digest summarizes key observations in the private equity and venture capital ecosystem of the rapidly evolving and exponentially

EU China Greentech

BGTA Accelerator and INSEAD present EU China Greentech whitepaper. Launched in 2021, the China and Europe Green Corridor seeks to increase EU–China collaborations on greentech, particularly in the form of

Lack of Cross-Border Investing by Business Angels Harmful to Innovation

The EU lags behind both the US and China in its number of high growth entrepreneurial firms (HGFs). These firms play a critical role in economic development as sources of

Coming of Age: Central and Eastern European Startups

Google for Startups, Atomico and Dealroom.co present “Coming of age: Central and Eastern European startups” report. Companies founded in CEE have now a combined enterprise value of over €186 billion,

Capital Markets Union – Key Performance Indicators (Fourth Edition)

AFME Finance for Europe presents Capital Markets Union – Key Performance Indicators, the fourth edition in a series of annual reports which tracks the development of the European capital markets ecosystem.

Promoting Cross-Border Investing by Business Angels in the European Union

The supply of entrepreneurial finance in Europe is constrained by the geographical fragmentation of its capital market. The need to facilitate more cross-border investing by business angels – the main

Business Angel Exits: a Theory of Planned Behaviour Perspective

Although there are a handful of studies on business angel investment returns, the business angel literature has given little or no attention to exits and the exit strategy. This is

The Global Startup Ecosystem Report – GSER 2021

In March 2020 startups’ prospects looked bleak. Consumer demand had cratered. Travel ceased. Struggling businesses shed workers or closed. Global VC spending dropped 17% in the first quarter compared to

NACO 2021 Report On Angel Investing In Canada

NACO is pleased to present the 2021 Report on Angel Investing in Canada, authored by world-renowned expert Colin Mason, Professor of Entrepreneurship at the University of Glasgow. This report has

2021 State of Nordic Impact Startups

Following it’s 2020 report, Dankse Bank has recently updated The State of Nordic Impact Startup report, which is based on a mapping of 1,200+ impact start-ups across the Nordic region, based on data

Danish Business Angels members invest DKK 1 million every day in Danish start-ups – all year round.

Danish Business Angels (DanBAN) and its members have made hundreds of investments in both Danish and foreign start-ups. The latest figures from the annual member

Pursuing Faith-Based Impact Investing: Insights on Financial Performance

The impact investing industry is increasing in sophistication, as more investors enter the fold and seek to create positive social and environmental impact alongside financial returns. For generations, one such

The Greek Startup Industry: Investments and Exits, 2010-2020

Marathon Venture Capital are providing evidence that the network of Greek entrepreneurs and technologists is consistently growing and its underlying value is increasingly materializing. By various accounts, the Greek startup

AAIA x AWS present the Angel Investing Report 2020

AWS are happy to present the Angel Investing Report 2020 in cooperation with the Austrian Angel Investing Association (aaia) and Austria Wirtschaftsservice (aws i2 Business Angels) on the 9th March

EIF Venture Capital, Private Equity Mid-Market & Business Angels Surveys 2020: Market sentiment, COVID-19 impact, Policy measures

2020 was an unprecedented and remarkable year, and also a year with high uncertainty and increased information needs. The EIF VC Survey, the EIF Private Equity Mid-Market Survey, and the EIF Business Angels

EBAN Statistics Compendium 2019

EBAN Publishes its 2019 Statistics Compendium - Reporting on the Activity of Business Angels and Business Angel Networks in Europe EBAN is pleased to present the new edition of the Annual

EBAN Data – Measuring Angel Market Data: 2020 Guidebook

EBAN Data Publishes its 2020 Guidebook on Measuring Angel Market Data - A Tool to Allow Comparison and Benchmarking between Investor Communities EBAN Data is delighted to announce the publication

EBAN Impact Investing Report

EBAN Impact Publishes its First Impact Investing Report - Reporting on Investor Background and Investment Characteristics EBAN Impact is delighted to announce the publication of our first Impact Investing Report

State of European Tech: 2020 Report

Each year, Atomico sets out a macro snapshot of our ecosystem in partnership with Slush and Orrick. Their goal is to chart progress and prompt further interrogation of how we

ACA Angel Funders Report 2020

The Angel Capital Association has published the 2020 Angel Funders Report, a deep dive into investment trends reflecting a growing North American angel ecosystem, benefitting communities with innovative new companies

Capital Markets Union Key Performance Indicators (Third Edition)

AFME has published a new report tracking the progress to date of the European Commission’s flagship Capital Markets Union (CMU) project through eight Key Performance Indicators (KPIs). The report, which EBAN contributed to, is

Q3 2020 Global Venture Report: Funding Holds Up And The Exit Markets Open

Depending on where you are in the world, we are eight to 10 months deep into a global pandemic without an end in sight. When lockdowns were rapidly implemented worldwide

Second Luxembourg-targeted angel investment deal of the year is announced in September

A total of 21 angel investment deals worth an aggregate EUR 47 million targeting companies based in Western Europe have been announced in September 2020 to date, compared to

The State of Nordic Impact Startups 2020

Following it's 2019 report focusing on The Sustainable Development Goals, Dankse Bank has recently updated The State of Nordic Impact Startup report, this time mapping the 10 most common myths

Angel Investors Target One Spanish Company in August

There have been 22 angel investment deals worth an aggregate EUR 39 million targeting companies based in Western Europe announced in August 2020 to date, according to Zephyr, the M&A

Czech Republic Angel Investors Survey 2020

DEPO Ventures, an EBAN member, is a unique investment platform that manages a seed investment fund a network of business angels while also providing M&A advisory services. During 2020, they

How to Mainstream Impact Investing in Europe

A detailed report written by Lisa Hehenberger for Stanford Social Innovation Review analyzing what investors and policy makers who want to advance impact investing in Europe need to account for.

Startup Ecosystem in Kosovo Report

Innovation Center Kosovo‘s latest research “Startup Ecosystem in Kosovo”, on the growing strategic importance of the sector for the country and its major role in economic growth. This study, financed

Swiss Venture Capital Report 2020 Update

A report by startupticker.ch and investor association SECA shows how investments developed in the first half of the year. Despite the COVID-19 crisis, a total of CHF 763.4 million in

Swiss Pharmaceutical Group Targeted by Angel Investors in July

There have been 27 angel investment deals worth an aggregate EUR 275 million targeting Western European companies announced in July 2020 to date, according to Zephyr, the M&A database published

Impact of COVID-19 on Europe’s Capital Markets: Market Update

AFME published, in July 2020, a new research note on the “Impact of COVID-19 on European Capital Markets: Market Update”. The purpose of this report is to provide an update

European Innovation Scoreboard 2020

The annual European Innovation Scoreboard (EIS) provides a comparative assessment of the research and innovation performance of EU Member States and selected third countries, and the relative strengths and weaknesses

Swiss ICT Investor Club: Investment report 2020

In 2019, SICTIC invested in 51 Swiss tech startups, up from 42 rounds in the year 2018. This contribution represents half of all ICT startups investments made in 2019 in

Funding Women Entrepreneurs: How to Empower Growth

Women are at the forefront of our fight against the coronavirus pandemic, representing 70% of the health and social sector workforce globally. As our economies are facing an unprecedented recession,

Irish Ticketing Platform Among Recipients of Angel Investment in June

At the time of writing, there have been 24 deals with an aggregate value of EUR 102 million involving angel investors injecting funds into Western European companies announced in June

UNH Finds Fewer Angels Invested More in 2019

DURHAM, N.H.—The angel investor market in 2019 saw a decrease in active investors and the number of investments overall but an increase in the total dollars invested by angels, according

THE CORONAVIRUS ECONOMIC CRISIS: ITS IMPACT ON VENTURE CAPITAL AND HIGH GROWTH ENTERPRISES

The European Commission’s Joint Research Centre (JRC) has published a paper on the Coronavirus economic crisis and its impact on venture capital and high growth enterprises, authored by Professor

Italian eco-friendly tech startup closes first seed round in May

A total of 29 angel investment deals worth an aggregate EUR 187 million targeting Western European companies have been announced in May 2020 to date, according to Zephyr, the M&A

UNH Finds Impact of COVID-19 Was Swift in the Angel Investing Market

DURHAM, N.H.—All signs indicate that 2020 is likely to be a challenging time for angel investing and the negative impact could be similar to the post 2000 decline and the

Space Funding Gateway 2020 – Practical guide to public funding of space-related businesses in Europe

This guide gives an overview of the public funding and financial opportunities that are available in Europe for space-related business. We are indeed at a turning point in terms of

Initial Impact of COVID-19 on European Capital Markets

During these unprecedented times in light of the COVID-19 outbreak, European capital markets have continued to intermediate market liquidity and facilitate risk management for corporates and investors. The purpose of

Finland-based earbud maker targeted in April’s largest European angel investment deal

The value of angel investment deals targeting Western Europe improved despite a decline by volume to 27 deals worth a combined EUR 123 million in April 2020 to date, according

FINNISH STARTUP FUNDING REACHED NEW HIGH IN 2019

In 2019, startups and growth companies raised a new record amount, totaling 511 million euro. Business angels invested 54 million, a new all-time high, and Finnish venture capital (VC)

Swedish boatmaker among March’s European targets of angel investment

March looks likely to decline on February’s result in terms of the volume and value of announced angel investment deals targeting companies based in Western Europe, according to Zephyr, the

European Angels Fund (EAF) publishes the first empirical analysis of its Business Angels portfolio

The EIF has recently published an update of the performances of the European Angels fund using its proprietary database, to shed light on a specific subset of the European business

Turkish software company targeted by angels in February

Both the volume and value of angel investment targeting Western European companies announced in February declined to 12 deals worth EUR 86 million, according to Zephyr, the M&A database published

Angel investors target Belgian healthy and organic products ecommerce marketplace during the traditional detox month of January

The volume and value of angel investment targeting Western European companies in January 2020 to date was decidedly slower than dealmaking recorded for the comparable three-week period in January 2019, according to

Activity declines for second consecutive month in the run-up to Christmas

The traditionally quieter holiday period has resulted in a decline in both volume and value of angel investment deals targeting Western European companies for the second consecutive month in December

Business Angel Investment, Public Innovation Funding and Firm Growth in Finland

The pioneering study conducted by The Research Institute of the Finnish Economy (Etla) has taken a giant leap to open up the mystery about the real effects of angel investments, as well

EBAN-Hockeystick Pilot Angel Deal Statistics Report

EBAN is pleased to publish the pilot results of its new research project conducted in collaboration with Hockeystick, a data analytics platform that also powers angel market reports for the Angel Capital Association and NACO

Statistics Compendium 2019 European Early Stage Market Statistics

EBAN Publishes its Annual Statistics Compendium - Reporting on the Activity of Business Angels and Business Angel Networks in Europe EBAN, the European Business Angels Network, is delighted to announce

November slows as holiday season approaches

The value of angel investment deals targeting companies based in Western Europe reached the highest-recorded result for any month in the entire year to date in October, representing the second

Compendium of European Co-Investment Funds with Business Angels

The Co-Investment Compendium is intended to assist business angels, entrepreneurs and other readers interested in the early stage investment market and learning about different forms of collaboration between business angels

2018 EBAN Compendium of Fiscal Incentives

Fiscal incentives have an important role in stimulating the activity of business angels and early stage equity investors in start-ups. They encourage private investors to diversify their portfolio towards unquoted

October investment has slowed down following a busy September

The volume and value of angel investment deals targeting companies based in Western Europe rebounded in September following the traditionally quieter holiday month of August, according to Zephyr, the M&A

AFME Report on Capital Markets Union (Second Edition)

AFME has published a new report tracking the progress to date of the European Commission’s flagship Capital Markets Union (CMU) project through eight Key Performance Indicators (KPIs). The report, which EBAN contributed to, is

Major takeaways of the Mining Space Summit 2019

White Paper from the Luxembourg Space Agency focusses on opportunities for collaboration between terrestrial and space mining sectors On 9 October 2019, the second Mining Space Summit gathered more than

September angel investment volume already surpasses August

The volume and value of angel investment deals targeting companies based in Western Europe slowed in the traditionally quieter holiday month of August, according to Zephyr, the M&A database published

Four angel investment deals in Western Europe had a known value in August

The volume of angel investment deals targeting companies based in Western Europe was unchanged month-on-month, despite value declining to 49 deals worth EUR 170 million in July 2019 from 49

Global Impact Investing Network’s 2019 Annual Impact Investor Survey

The Global Impact Investing Network (GIIN) published the ninth edition of its Annual Impact Investor Survey. Comprising data and insights from 266 of the world’s leading impact investors, the report provides in-depth analysis of

The State of Nordic Impact Startups

Danske Bank has published The State of Nordic Impact Startup a report on The Sustainable Development Goals(SDGs) that are set by the United Nations and adopted by 193 nations – including the Nordic countries.

A Single Portuguese Angel Investment was Announced in April

There were 38 angel investment deals worth an aggregate EUR 180 million targeting Western European companies announced in March 2019, according to Zephyr, the M&A database published by Bureau van

Swiss Crypto Fintech Startup Attracted Backing in March

There were 45 angel investment deals worth an aggregate EUR 333 million targeting Western European companies announced in February 2019, according to Zephyr, the M&A database published by Bureau van

German Hardware Company Among February’s Recipients of Angel Investment

January 2019 was a relatively quiet month in terms of the volume and value of announced angel investment deals targeting Western European companies as 35 such deals worth a combined

Space Angels – The Definitive Career Guide to Entrepreneurial Space

The space industry is in the midst of a radical transformation. When SpaceX started launching its rockets a decade ago–making it far easier for commercial space startups to enter the

2018 Annual Investor European Venture Report – by PitchBook

PitchBook provides comprehensive data on the private and public markets—including companies, investors, funds, investments, exits and people—to help global M&A professionals map the market, find target companies, execute deals and more.

Pymwymic Report on ‘What it really takes to be a value-add investor’

Pymwymic has published a new report how they impact investors, contribute to or constrain the success of their investee companies. In the report entitled 'What it really takes to be a value-add

One angel investment deal targeted a Belgium-based company in January

There have been 11 angel investments worth an aggregate EUR 43 million targeting companies based in Western Europe announced in January 2019, according to Zephyr, the M&A database published by

Angel Investing Report 2018

The Austrian Angel Investors Association has released its Angel Investing Report 2018, the most comprehensive analysis of the Austrian angel investing industry ever. It provides answers to the big questions of this dynamic

The future of the European space sector – How to leverage Europe’s technological leadership and boost investments for space ventures

Europe boasts a strong space sector. This is largely the legacy of successful space programmes, particularly those on satellite navigation and Earth observation, mostly built on public support. However, the

Vegan pizza manufacturer among December’s targets of angel investment

Among the usual raft of software companies, angel investors also targeted a vegan pizza manufacturer in December 2018. In all, there were 24 deals worth a combined EUR 161 million

GP Bullhound 2019 Technology Predictions Report

Technology’s transformative effect has touched every corner of today’s world. Its commercial, social and political impact has been unprecedented. Now entering its 12th year, GP Bullhound's Technology Predictions report demonstrates

Compendium of European Co-Investment Funds with Business Angels

This latest edition of EBAN’s Compendium of Co-investment Funds with Business Angels is intended to assist business angels, entrepreneurs and other readers interested in the early stage investment market and

EU Startup Monitor 2018 Report

EU Startup Monitor has published its 2018 Report. The report studies the EU startup market and analyses the characteristics and challenges startups face in today's market. The goal of the EU

The Status of Open Innovation in Europe – Report by Mind the Bridge and Nesta

Innovation is key to sustained corporate success. Innovative firms grow twice as fast, both in employment and sales, as firms that fail to innovate. However, European companies spend less on

StartupCity Hubs in Europe by Mind the Bridge

Research from Mind the Bridge shows that 67% of the European scaleups are located around one or maximum two cities per country. That means that the innovation economy in Europe

Jewellery company targeted by angel investors in November

In an unusual turn of events, a jewellery retailer based in the UK was targeted by angel investors in November, according to Zephyr, the M&A database published by Bureau van

EBAN Activity Report June 2017 – June 2018

EBAN is pleased to present the latest edition of its annual Activity Report, detailing our activities and initiatives over the period of June 2017 – June 2018. The report includes

2018 Go Beyond Investor report: Insights on Angel Portfolio Returns

This year’s Go Beyond Investor Report takes a deep look into Go Beyond Investing (GBI) member community, all the investments they have made and the returns that have been delivered.

Angel Investing in Africa Report

Download the report on angel investing in Africa entitled "State of Play: Finding Product/Market Fit" - A first ever scoping study on angel investing in Africa by ABAN, the African

Assessment of the financing needs of space SMEs in Europe

The space industries, since their inception in the late 1940s, have been discrete, relatively niche sectors whereby political and military considerations superseded scientific and market rationales. This status quo is

AFME Report on “Capital Markets Union KPIs: Measuring progress and planning for success” Edit

AFME has published a new report tracking the progress to date of the European Commission’s flagship Capital Markets Union (CMU) project through seven Key Performance Indicators (KPIs). The report, which EBAN contributed to, is

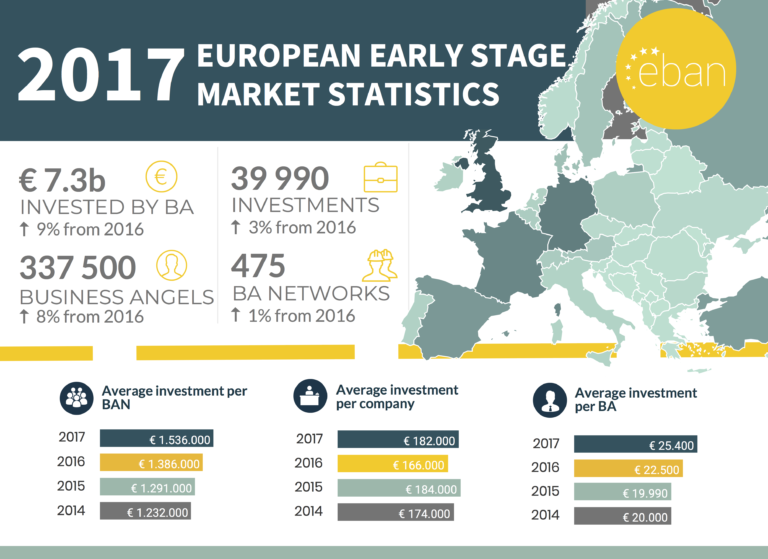

2017 Annual EBAN Statistics Compendium

EBAN, the European Trade Association for Business Angels, Seed Funds and Early Stage Market Players, is delighted to announce the EBAN 2017 Annual Statistics Compendium – Europe’s most extensive annual research

2017 EBAN Compendium of Fiscal Incentives

EBAN, the European Trade Association for Business Angels, Seed Funds and Early Stage Market Players is proud to present the new edition of its much anticipated annual mapping of fiscal

Startup investment and ecosystems across Central and Eastern Europe

East-West Digital News has released a comprehensive research about startup investment and innovation across Central and Eastern Europe. The report contains a series of interviews with investors, entrepreneurs and experts,

Business Model Development Toolkit for AAL Projects

EBAN would like to disseminate an excellent toolkit that was created by VTT in the framework of the AAL2Business Support Action. This toolkit is an excellent publication on business model

ACA Guide on How to Start and Manage an Angel Group

As more and more investors and communities recognize the benefits of establishing angel groups, it's important to have resources that ensure that they don't have to recreate the wheel. The

ACA Webinars, Articles and Podcasts on the Basics of Angel Investing

ACA in partnership with leading organizations, has created the Rising Tide Education Program, helping new angels discover the basics of becoming an angel investor with this unique collection of educational resources.

A guide to Sustainable Development Goals Interactions

The International Council for Science has published a report that explores the nature of interlinkages between the Sustainable Development Goals (SDG). It is based on the premise that a science-informed analysis

Lasting impact: The need for Responsible Exits

The Global Impact Investment Network (GIIN) has recently published a new report, Lasting Impact: The Need for Responsible Exits, which reveals insights into how impact investors enable the organizations and projects

European Commission Report on Effectiveness of Tax Incentives for Venture Capital and Business Angels

The Capital Markets Union project (CMU) aims to strengthen the single market by deepening the integration of investment across the European Union. Improved access to finance is a key component

EBAN 2016 Statistics Compendium

The EBAN 2016 Statistics Compendium is Europe’s most extensive annual research on the activity of business angels and business angel networks. It provides information on the overall early stage market,

EU Commission Study: Understanding the Nature and Impact of the business angels in Funding Research and Innovation

The investment of business angels in Research and Innovation (R&I) is a crucial complement to supporting start-up companies through national incentives to invest. It represents the most significant source of

2016 EBAN Compendium of Fiscal Incentives

EBAN is proud to present the new edition of its much anticipated annual mapping of fiscal incentives available to business angels in Europe in 2016. EBAN, the European Trade Association

2016 EBAN Compendium of Co-investment Funds with Business Angels

This edition of EBAN’s Compendium of Co-investment Funds with Business Angels is intended to assist business angels, entrepreneurs and other readers interested in the early stage investment market and learning,

Anges Québec Capital Glossary

This glossary, produced by Anges Québec, contains original definitions as well as definitions imported from various sources. To that effect, Anges Québec thanks First Angel Network, GoTroo, National Angel Capital

NACO Term Sheets

Below you will find the 4 term sheets produced for the NACO Common Docs project Common Shares A Common Share deal aligns founders and funders with the same class of

A Practical Guide to Angel Investing: How to Achieve Good Returns by NACO

NACO has announced the release of the first NACO Academy publication A Practical Guide to Angel Investing: How to Achieve Good Returns. Written by Dr. Steven A. Gedeon, the Guidebook is

The Shortage of Risk Capital Report

Industry calls for more action on risk capital for Europe’s high growth firms. AFME has published a new report examining the specific challenges associated with raising risk capital for small

Raising Business Angel Investment – European Booklet for Entrepreneurs

This publication is the result of an agreement signed between EBAN and HBAN with the purpose of serving the organisations’ mutual goals of increasing the quantity, quality and success of