What is an Investment Lighthouse

Investment Lighthouses are platforms driven by Business Angel Networks (BANs) aimed at fostering innovation and collaboration. They facilitate access to curated startups, provide essential resources, ensure regulatory compliance, and sustain success in the European financing ecosystem.

Who is it for?

Investment Lighthouses are designed for investors seeking high-quality opportunities and startups looking for funding and support. They also benefit BANs aiming to expand their networks and enhance investment activities.

What are Investment Lighthouses for?

– Facilitate access to curated dealflow and opportunities.

– Engage in events and forums to build relationships and share knowledge.

– Connect with a diverse and robust network of stakeholders.

– Stay informed about the regulatory landscape and gain access valuable

Spain’s early-stage investment ecosystem is one of the most mature in Europe, driven by a strong network of professionalized business angel groups, family offices, early-stage funds, and institutional partners. The Spanish Association of Business Angels Networks (AEBAN) is the national umbrella organization that unites more than 40 local networks and over 3,000 business angels across Spain. Since its founding in 2008, AEBAN has been instrumental in promoting professional standards, syndication practices, and investor education.

Spain’s startup landscape is vibrant and diverse, with Madrid and Barcelona leading as major hubs for tech startups in sectors such as ICT, fintech, biotech, life sciences, renewable energy, and creative industries. The ecosystem benefits from strong government support through organizations like ICEX-Invest in Spain, regional development agencies, and corporate partners such as CaixaBank DayOne, which back startups with funding, internationalization support, and soft landing programs.

With increasing cross-border syndication and a robust culture of co-investment, Spain continues to consolidate its position as a gateway to Europe and Latin America for early-stage capital and scalable innovation.

The country’s startup scene—driven by technical talent and a culture of innovation—has gained international recognition in sectors like AI, deep tech, and creative SaaS. With strong diaspora support, international partnerships, and government backing, Armenia is quickly positioning itself as a strategic and high-potential destination for investors seeking emerging market opportunities with global scalability.

Spain’s dealflow is highly diversified, with active pipelines in digital tech, healthtech, cleantech, and advanced manufacturing.

Key highlights:

– Active angel community: Around 89% of business angels in Spain made at least one investment in 2023. The average annual investment per angel was around €49,700.

– Strong co-investment culture: More than 80% of investments are syndicated. Over 40% of angel deals include foreign co-investors, mainly from the UK, US, France, and other European markets.

– Regional networks: Madrid and Catalonia account for roughly two-thirds of angel activity, but regional networks like BANC (Catalonia), BIGBAN (Valencia), FIDBAN (Cantabria), and others play an important role in sourcing early-stage opportunities nationwide.

– Sector diversity: High-potential startups operate across ICT, SaaS, AI, biotech, agritech, energy, and impact-driven sectors.

Spain offers a rich calendar of events and networking opportunities for angels and founders:

– AEBAN Annual Congress and Investment Summits: The main annual gathering of Spain’s business angel community, featuring high-level policy discussions, workshops, pitch sessions, and awards.

– Regional pitch days and meetups: Local angel networks and incubators organize frequent pitching forums, demo days, and investor breakfasts across regions.

– Educational programs: The IESE Business Angels & Family Offices Academy, run in partnership with AEBAN, provides structured training for new and experienced angels in Barcelona, Madrid, and other cities.

– International conferences: Many Spanish angel groups are active participants in European-level events through AEBAN’s membership in EBAN (European Business Angels Network).

Spain combines investor-friendly conditions with structured learning and support:

– Best practices and research: AEBAN regularly publishes market reports and best practice guidelines in collaboration with IESE Business School and other academic partners.

– Workshops and certification: AEBAN and affiliated networks run practical workshops covering valuation, due diligence, legal frameworks, and syndication strategies.

– Public support: National and regional incentives include startup tax breaks, support for seed capital, and co-investment schemes through instruments like ENISA and the FondICO Global fund.

– Business-friendly environment: Spain offers streamlined company formation, EU market access, and numerous regional innovation hubs.

AEBAN and its network of partners provide multiple opportunities for co-investment and syndication:

– Syndicated rounds: Angels collaborate closely with local VCs, family offices, corporate investors, and international partners, allowing larger round sizes and diversified portfolios.

– Institutional partnerships: Strategic alliances with CaixaBank DayOne, ICEX-Invest in Spain, and European networks create bridges for startups to expand and attract foreign capital.

– Academic and corporate links: Collaborations with top business schools (IESE, ESADE) and corporate open innovation programs offer additional dealflow and support for scaling.

– Cross-border reach: Spain’s position within the EU and strong ties with Latin American markets make it an attractive entry point for regional and global syndication.

Spain’s startup and angel investment ecosystem has produced a growing number of high-profile success stories, demonstrating the scalability and global competitiveness of companies emerging from local angel-backed dealflow. These examples highlight the impact of Spain’s professional angel networks, early-stage funds, and supportive institutional framework.

Founded in Madrid in 2011, Cabify started as a premium ride-hailing service backed by early Spanish investors and accelerators like SeedRocket, along with support from international VCs such as Seaya Ventures. Its strong presence in Spain and early expansion into Latin America attracted major funding rounds from investors including Rakuten and TheVentureCity. In 2018, Cabify became Spain’s first unicorn, valued at over $1 billion, marking a milestone for the country’s tech ecosystem and setting the stage for further growth across markets in Europe and LATAM.

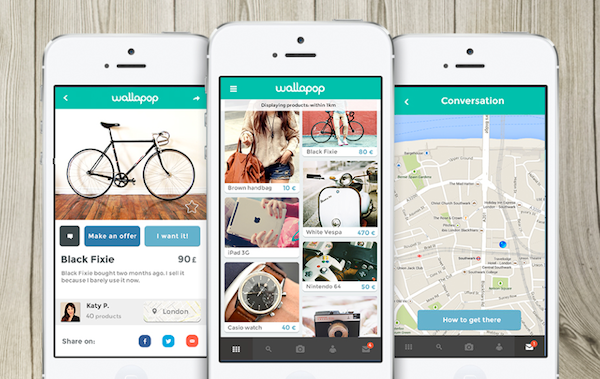

Launched in Barcelona in 2013, Wallapop is a peer-to-peer marketplace for second-hand goods. The company was initially backed by local business angels and Spanish VC firms such as Antai and Bonsai Ventures. Wallapop’s growth attracted large international backers, including Accel and Insight Partners. The company has raised over €400 million and continues to expand across Southern Europe.

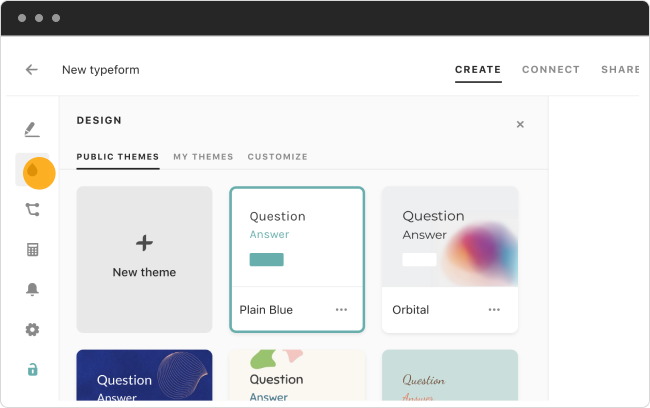

Typeform, a Barcelona-based SaaS company known for its user-friendly online forms and surveys, received seed-stage support from local angels and VCs, including Point Nine Capital. Typeform scaled quickly due to its product-led growth and global customer base, securing later rounds from international investors such as Index Ventures and General Atlantic. Today, Typeform is one of Europe’s leading examples of a design-focused, scalable SaaS success.

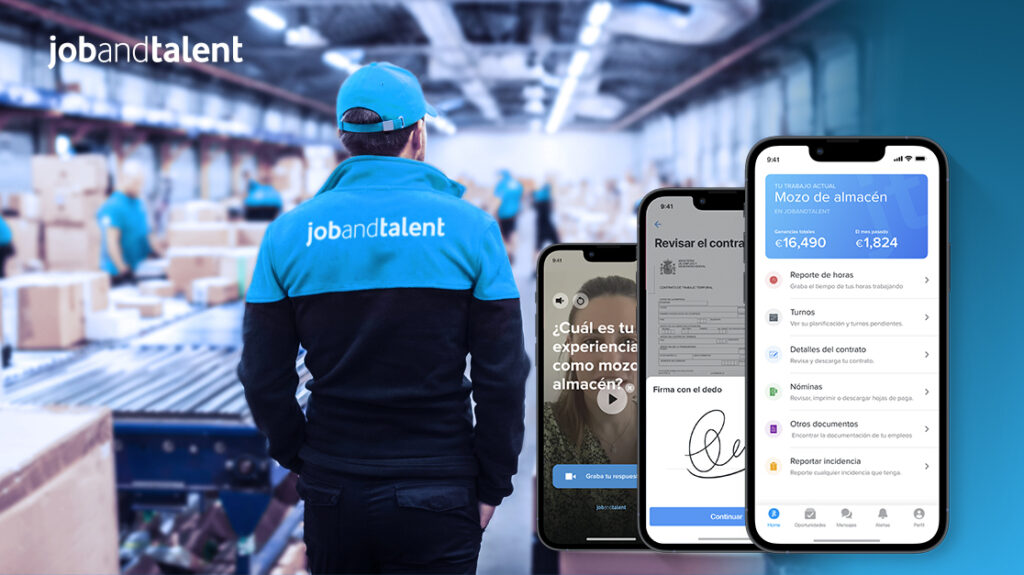

Founded in Madrid in 2009, Jobandtalent is a digital temp staffing platform that began with backing from Spanish angels and family offices. Early-stage capital enabled the company to develop its proprietary matching technology and expand into multiple European markets. The startup has since raised over $800 million from global investors including SoftBank and Atomico, becoming one of Spain’s few HR tech unicorns.

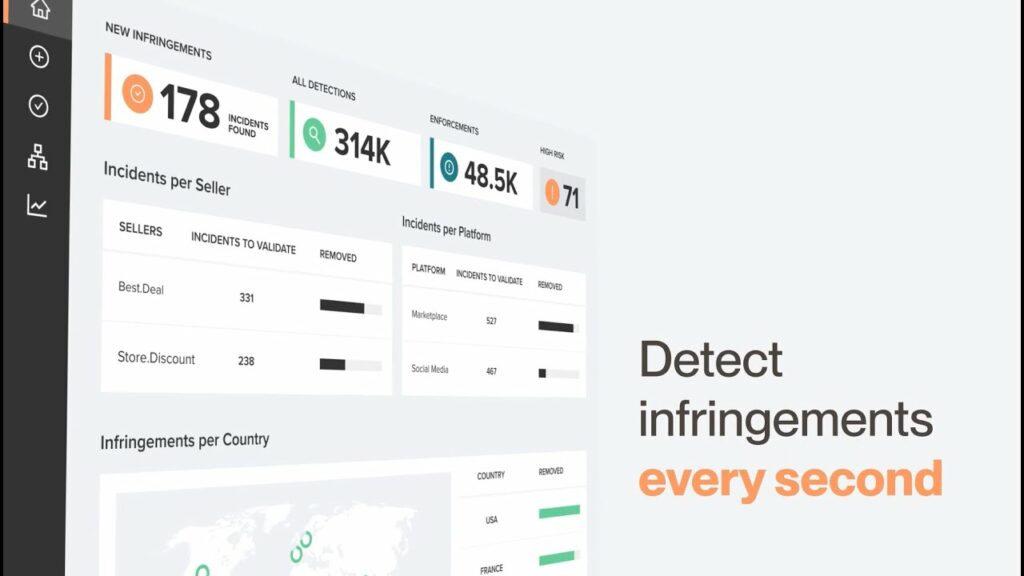

Red Points, founded in Barcelona, started with local angel backing and support from networks such as BANC and IESE’s investor community. The company’s SaaS platform combats online piracy and brand abuse. Early traction attracted international funds like Northzone and Summit Partners. Red Points now protects global brands and continues to expand its anti-counterfeiting solutions worldwide.