One of EBAN’s main activities is to do research on the early stage and business angel markets. Annually, EBAN publishes 3 different Compendia: The Statistics Compendium, which takes the pulse of the European early stage market in terms of investment activity, the Compendium of Co-Investment Funds and the Compendium of Fiscal Incentives, which map the tax schemes and investment funds available for angel investors throughout Europe. On top of this, EBAN works together with its members and partners such as the EU, OECD and AFME, on other research related publications and position papers.

Check out out latest annual publications:

EBAN publications archive:

EBAN Annual Statistics Compendium for 2022

EBAN presents the EBAN Annual Statistics Compendium for 2022, Europe's most extensive annual research on the activity of business angels and business angel networks. The Compendium offers comprehensive insight into

EBAN Data Report: Business Angel Networks and Angel Federations in Europe 2023

This report by EBAN provides a list of all Business Angel Networks and Federations currently active in Europe. It has been compiled through a combination of online resources and data

EBAN Data – Agrifood sector in Europe

In this EBAN Data Monthly Report, we present an overview of the agrifood entrepreneurial and investment ecosystem in Europe (including Türkiye), with a focus on the investments in Agrifood companies

EBAN Impact Investing Report 2021 – 2nd Edition

EBAN Impact Publishes its 2nd Annual Impact Investing Report – Reporting on Investor Background and Investment Characteristics EBAN Impact is delighted to announce the publication of our 2nd edition of

Capital Markets Union Key Performance Indicators – Fifth Edition by AFME

AFME, EBAN, and 10 other organisations published the fifth edition of the “Capital Markets Union – Key Performance Indicators” report. Over the last five years, this report has tracked the

Statistics Compendium 2021 European Early Stage Market Statistics

EBAN Publishes its Annual Statistics Compendium - Reporting on the Activity of Business Angels and Business Angel Networks in Europe Data on the investments made across the 38 different European

SpaceTech Across Europe, report 2022

In this report we present an overview of the investments in the SpaceTech companies done in Europe between 2017 and 2021, with a focus on the most recent years 2020-2021.

Statistics Compendium 2020 European Early Stage Market Statistics

EBAN Publishes its Annual Statistics Compendium - Reporting on the Activity of Business Angels and Business Angel Networks in Europe EBAN, the European Business Angels Network, is delighted to announce

Capital Markets Union – Key Performance Indicators (Fourth Edition)

AFME Finance for Europe presents Capital Markets Union – Key Performance Indicators, the fourth edition in a series of annual reports which tracks the development of the European capital markets ecosystem.

EBAN Statistics Compendium 2019

EBAN Publishes its 2019 Statistics Compendium - Reporting on the Activity of Business Angels and Business Angel Networks in Europe EBAN is pleased to present the new edition of the Annual

EBAN Data – Measuring Angel Market Data: 2020 Guidebook

EBAN Data Publishes its 2020 Guidebook on Measuring Angel Market Data - A Tool to Allow Comparison and Benchmarking between Investor Communities EBAN Data is delighted to announce the publication

EBAN Impact Investing Report

EBAN Impact Publishes its First Impact Investing Report - Reporting on Investor Background and Investment Characteristics EBAN Impact is delighted to announce the publication of our first Impact Investing Report

Capital Markets Union Key Performance Indicators (Third Edition)

AFME has published a new report tracking the progress to date of the European Commission’s flagship Capital Markets Union (CMU) project through eight Key Performance Indicators (KPIs). The report, which EBAN contributed to, is

Statistics Compendium 2019 European Early Stage Market Statistics

EBAN Publishes its Annual Statistics Compendium - Reporting on the Activity of Business Angels and Business Angel Networks in Europe EBAN, the European Business Angels Network, is delighted to announce

Compendium of European Co-Investment Funds with Business Angels

The Co-Investment Compendium is intended to assist business angels, entrepreneurs and other readers interested in the early stage investment market and learning about different forms of collaboration between business angels

2018 EBAN Compendium of Fiscal Incentives

Fiscal incentives have an important role in stimulating the activity of business angels and early stage equity investors in start-ups. They encourage private investors to diversify their portfolio towards unquoted

AFME Report on Capital Markets Union (Second Edition)

AFME has published a new report tracking the progress to date of the European Commission’s flagship Capital Markets Union (CMU) project through eight Key Performance Indicators (KPIs). The report, which EBAN contributed to, is

Compendium of European Co-Investment Funds with Business Angels

This latest edition of EBAN’s Compendium of Co-investment Funds with Business Angels is intended to assist business angels, entrepreneurs and other readers interested in the early stage investment market and

EBAN Activity Report June 2017 – June 2018

EBAN is pleased to present the latest edition of its annual Activity Report, detailing our activities and initiatives over the period of June 2017 – June 2018. The report includes

AFME Report on “Capital Markets Union KPIs: Measuring progress and planning for success” Edit

AFME has published a new report tracking the progress to date of the European Commission’s flagship Capital Markets Union (CMU) project through seven Key Performance Indicators (KPIs). The report, which EBAN contributed to, is

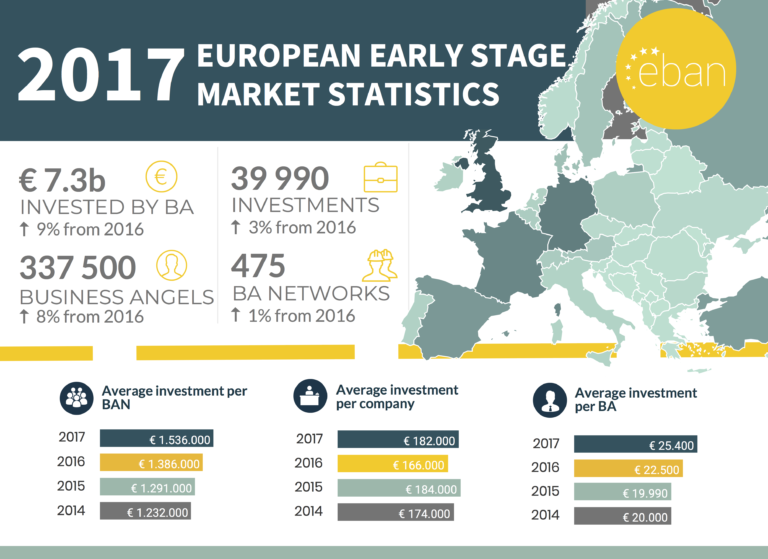

2017 Annual EBAN Statistics Compendium

EBAN, the European Trade Association for Business Angels, Seed Funds and Early Stage Market Players, is delighted to announce the EBAN 2017 Annual Statistics Compendium – Europe’s most extensive annual research

2017 EBAN Compendium of Fiscal Incentives

EBAN, the European Trade Association for Business Angels, Seed Funds and Early Stage Market Players is proud to present the new edition of its much anticipated annual mapping of fiscal

Startup investment and ecosystems across Central and Eastern Europe

East-West Digital News has released a comprehensive research about startup investment and innovation across Central and Eastern Europe. The report contains a series of interviews with investors, entrepreneurs and experts,

EBAN Report On Why Business Angels Do Not Invest

EBAN is pleased to present its latest research report focused on understanding the reasons why angel investors choose not to invest in early stage SMEs. The report, titled “Why Business

EBAN 2016 Statistics Compendium

The EBAN 2016 Statistics Compendium is Europe’s most extensive annual research on the activity of business angels and business angel networks. It provides information on the overall early stage market,

EU Commission Study: Understanding the Nature and Impact of the business angels in Funding Research and Innovation

The investment of business angels in Research and Innovation (R&I) is a crucial complement to supporting start-up companies through national incentives to invest. It represents the most significant source of

2016 EBAN Compendium of Fiscal Incentives

EBAN is proud to present the new edition of its much anticipated annual mapping of fiscal incentives available to business angels in Europe in 2016. EBAN, the European Trade Association

2016 EBAN Compendium of Co-investment Funds with Business Angels

This edition of EBAN’s Compendium of Co-investment Funds with Business Angels is intended to assist business angels, entrepreneurs and other readers interested in the early stage investment market and learning,

The Shortage of Risk Capital Report

Industry calls for more action on risk capital for Europe’s high growth firms. AFME has published a new report examining the specific challenges associated with raising risk capital for small

Fostering Business Angel Activities in Support of SME Growth

EBAN is proud to present the Guidebook on “Fostering Business Angel Activities in Support of SME Growth”. Written by EBAN for the European Commission as part of a series, this

Investing in Private Companies – Insights for Business Angel Investors

This publication is the result of an agreement signed between EBAN and HBAN with the purpose of serving the organisations’ mutual goals of increasing the quantity, quality and success of

Raising Business Angel Investment – European Booklet for Entrepreneurs

This publication is the result of an agreement signed between EBAN and HBAN with the purpose of serving the organisations’ mutual goals of increasing the quantity, quality and success of